When the Consumer Financial Protection Bureau (CFPB) finalized the Qualified Mortgage (QM) rule, they included a very important exemption for certain loans backed by Fannie Mae and Freddie Mac.

This was implemented to ensure a large portion of the mortgage market wasn’t disrupted by the new mortgage rules implemented back in 2014.

But when the provision was added to the Ability to Repay/Qualified Mortgage Rule, it came with an expiration date of January 10th, 2021, or earlier if the government sponsored enterprises (GSEs) ceased to be in conservatorship.

While that worry was effectively shelved for years, the deadline is now rapidly approaching, so it’s time to consider the impact of the GSE patch expiration.

What Is the GSE Patch?

Known in the industry as the “GSE patch,” it provides temporary qualified mortgage status to certain mortgage loans eligible for purchase or guarantee by Fannie Mae and Freddie Mac, which are the two GSEs.

Specifically, these home loans are given QM status even if the debt-to-income ratio (DTI) exceeds the 43 percent threshold otherwise required to obtain qualified mortgage status.

They are known as “Temporary GSE QM,” and instead of being subject to QM standards, GSE underwriting standards are acceptable.

Importantly, these loans are granted a safe harbor from legal liability in connection with the CFPB’s Ability to Repay (ATR) requirements as a result.

But come early 2021, or after a short extension, if granted, they will no longer enjoy such assurances.

And that could push tons of loans into the non-QM space, assuming something isn’t worked out, and borrowers continue to require mortgages with DTIs above 43%.

How Many Loans Are Affected by the GSE Patch Expiration?

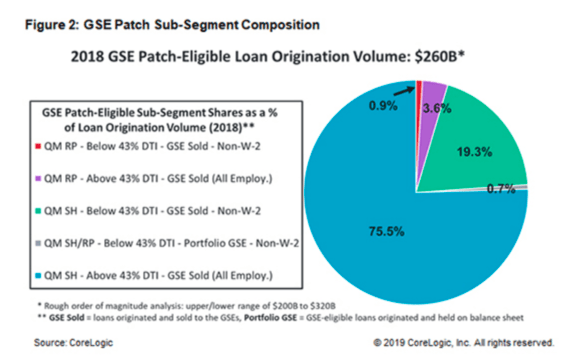

A new analysis by CoreLogic revealed that a staggering $260 billion, or 16% of all 2018 home loan originations, were covered by the GSE patch.

Assuming the GSE patch had expired at the beginning of 2018, those $260 billion in mortgage loans would have needed to be originated by non-QM lenders.

As such, the homeowners would likely have had to settle for higher mortgage rates, and/or they may have had more difficulty actually obtaining financing.

Who Will Be Most Affected by the GSE Patch Expiration

In another blog post, CoreLogic analyzed which types of homeowners would be most affected by the expiration of the GSE patch.

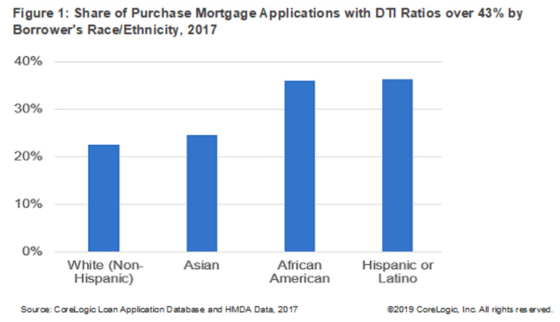

It turns out African American and Hispanic or Latino borrowers would see the most impact, as seen in the illustration above.

These groups were approximately 1.6 times more likely to have a DTI that exceeded 43% versus Non-Hispanic White borrowers, based on 2017 HMDA data.

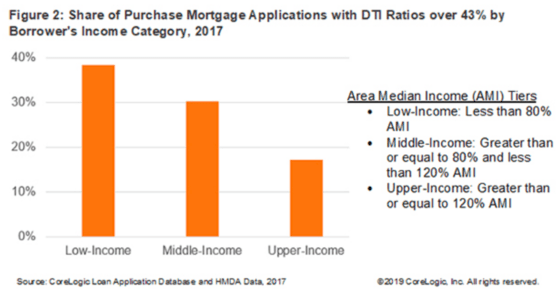

The same was true of low-income borrowers, which you could argue is obvious given the DTI is a measure of one’s income.

These low-income borrowers were more than twice as likely as the upper-income borrowers to have a DTI over 43%.

Ultimately, the patch covers more home purchases in underserved areas the country, which might dictate policy change in this department.

Either way, it’s clear that non-QM lenders stand to gain significantly once the patch expires, assuming it does expire.

With a quarter trillion dollars up in the air, it’s abundantly clear the stakes will be high in the non-QM space once 2021 rolls around.