One of the key components of the Qualified Mortgage rule is the 43% debt-to-income limit, a longstanding measure of homeowner affordability.

When the Consumer Financial Protection Bureau (CFPB) wrote the QM rule, they excluded high-DTI ratio mortgages because studies have demonstrated that borrowers with higher DTIs are more likely to experience payment trouble.

As such, the rigid DTI limit lessens the incentive for mortgage lenders to originate such loans, knowing they won’t receive the valuable protections that come with QM loans.

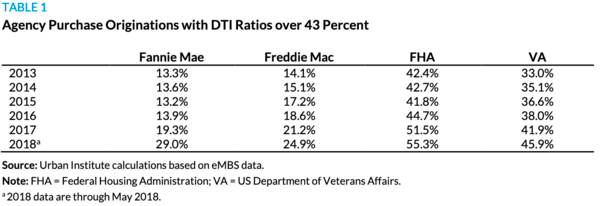

In practice, this hasn’t been much of an issue because the GSE patch provides an exemption to the max DTI rule while Fannie Mae and Freddie Mac are under government conservatorship.

Additionally, the FHA, VA, and USDA are governed by their own set of rules that do not include maximum DTI caps.

But the grace period for Fannie and Freddie may end soon, either by January 10th, 2021, or earlier if a plan to get them back to quasi-public companies materializes before then.

This has caused some of the largest mortgage lenders and housing advocacy groups, including the ABA, Bank of America, CUNA, Quicken Loans, and Wells Fargo to take action.

Eliminate DTI Ratio Requirement and Appendix Q

In a letter dated August 9th, 2019 to the CFPB, the coalition asked Director Kathleen L. Kraninger to drop the DTI requirement and associated Appendix Q from the general QM category.

They argue that the “DTI ratio is not intended to be a stand-alone measure of credit risk,” and that it’s “widely recognized as a weak predictor of default and one’s ability to repay” on its own.

While there’s probably data to the contrary, it is true that DTI is just one of the many risk factors underwriters must consider when evaluating a home loan, along with things like employment history, credit scores, and collateral.

Check out this chart from the Urban Institute, which shows that DTI ratio isn’t necessarily the biggest driver of default, relative to credit score and loan-to-value ratio (LTV).

The group highlighted the fact that the GSE Patch covered an estimated $260 billion, or 16% of 2018 home loan originations.

Without it, scores of would-be home buyers would miss out, including millions of lower-income underserved borrowers who they argue often demonstrate “greater levels of creditworthiness.”

In short, the group wants the CFPB to remove both the DTI ratio threshold and Appendix Q for prime and near-prime loans.

They believe this will usher in increased competition across the mortgage universe, reduce systemic risk, and expand investor and private insurer participation.

For example, if the hard DTI limit remains in place, there’s a good chance the riskiest borrowers (from a DTI standpoint) will flock to the FHA, putting more pressure on that agency.

As a result, there is a good chance the CFPB will budge on this front, especially if the ability to repay (ATR) remains in place.

After all, the automated underwriting systems of Fannie and Freddie already allow higher DTIs if certain conditions are met, and the government housing agencies allow the same.

And there’s a reason a patch was implemented in the first place – they knew it would be highly disruptive to the mortgage market.

So the coalition is likely to get its way, for better or worse. Whether it will come with additional conditions remains to be seen.

(Flickr photo: Marcin Wichary)