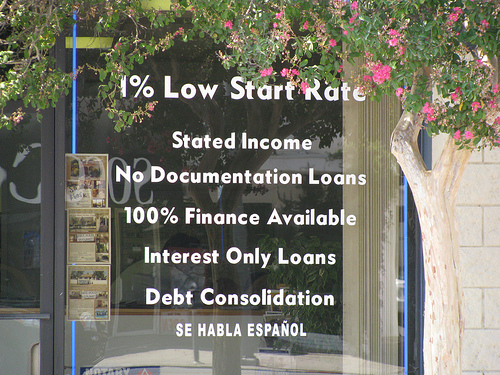

One of the biggest things the QM rule did was eliminate interest-only mortgages from the mainstream.

Sure, it didn’t make them illegal to originate, but it did make them less desirable to originate from a lender’s perspective because they aren’t protected by the Qualified Mortgage rule.

Instead, they are considered non-QM loans, meaning only a handful of lenders still offer them.

However, it appears that lenders still have an appetite for mortgages where borrowers merely need to make the interest-only payment.

A new tally from Inside Nonconforming Markets, part of Inside Mortgage Finance, found that interest-only mortgage lending was up 8.5% in 2015 from a year earlier.

The numbers are based on volume from 12 lenders tracked by the company, which I assume are the biggest interest-only mortgage lenders still around.

Despite the QM rule in place, the group was able to originate $29.56 billion in interest-only mortgages during the year.

Obviously it’s a far cry from the good old days, but it’s still a respectable amount, and on an upward trajectory.

However, the group was only able to muster $6.88 billion in IO production during in the fourth quarter of 2015, a 6.6% decline compared to the previous quarter. It’s unclear if it was just a seasonal decline and we’re still awaiting first quarter 2016 results.

PHH Mortgage the Top Interest-Only Mortgage Lender

If you’re wondering who the king of IO is, it’s PHH Mortgage, which reported total volume of $13.64 billion in 2015.

IMF pointed out that PHH originates interest-only mortgages for “a number of clients,” and I believe that includes Merrill Lynch, which just announced it was taking its origination business in-house.

That could greatly effect PHH’s loan volume, assuming Merrill offers IO loans to its clients directly going forward. And my guess is a lot of high net-worth clients favor IO loans so they can put their money to work elsewhere.

Regardless, interest-only loans are still widely available, though underwriting standards are tougher than they used to be, and it may help to have an existing relationship with a wealth management company like Merrill Lynch.

Inside Mortgage Finance noted that interest-only loans “appear to be the most common type of non-QM” offered by lenders.

Check out my list of lenders that still offer interest-only mortgages.

Do you know who is actually buying the interest only loans? Who is buying the closed and funded loans from JMAC, PHH and Cal Fed

Tom,

Presumably REITs or they’re just kept on the lender’s books.