Just a few weeks after the Consumer Finance Protection Bureau (CFPB) revealed its intention to move away from the DTI limit on Qualified Mortgages, Fitch Ratings released its own take on the matter.

In a nutshell, they believe it could weaken borrower protection and usher in “aggressive lending practices,” two major reasons why the QM rule exists in the first place.

As earlier reported, the CFPB wants to replace the hard 43% debt-to-income ratio (DTI) limit with a pricing threshold instead.

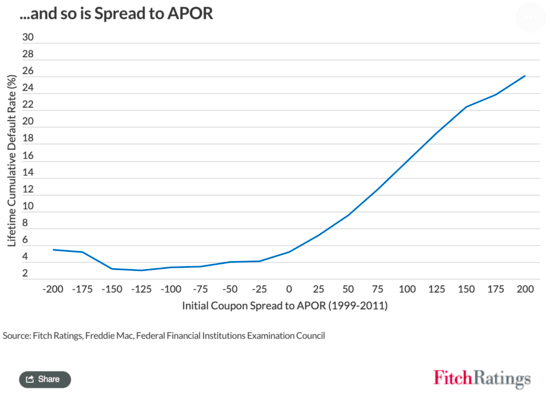

One measure being floated is a certain spread over the average prime offered rate (APOR), which could be a defining line for a Qualified Mortgage as opposed to using a borrower’s DTI.

DTI a Better Indicator of Default than Spread to APOR

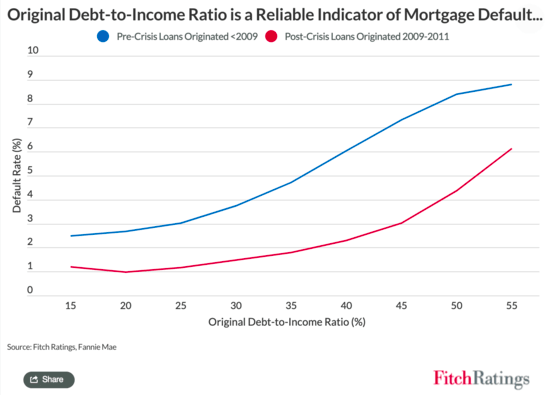

While Fitch did admit that both spread to APOR and DTI “are good indicators of default,” the rating agency feels DTI is superior.

“DTI is a better measure of a borrower’s ability to repay a new mortgage loan without having to sell the home or leverage existing equity if financially stretched, which is the primary purpose of the ATR Rule,” the report said.

As seen in the chart above, there’s a clear correlation between default rates and high DTI ratios, especially when it hits that ~45% mark.

It’s especially relevant to post-crisis home loans, which are probably a better measure than what was being underwritten (if you could even call it that) in the early 2000s.

“Mortgage origination standards since the crisis were some of the most stringent in recent history limiting mortgage credit to only the most qualified borrowers. Yet, even with the most restrictive qualification standards, DTI remains a key predictor of borrower default.”

Low APRs May Be Fine for Mortgage Lenders, But Still Bad for Borrowers

With regard to spread to APOR, they note that a lot goes into pricing a mortgage loan, some of which may have little to do with the borrower’s capacity to pay.

“These include liquidity, market movements, or attributes that present a low risk of loss to the lender, for example a low loan-to-value (LTV).”

Their worry is “aggressive” home loan programs could still feature low APRs, high DTIs, and a low LTV, which would make borrower affordability an issue but present little risk to the originating lender.

Unfortunately, the QM rule is in place to protect borrowers, not mortgage lenders.

Fitch admits that DTI hasn’t historically been as strong a predictor of default as other loan attributes like credit score and LTV, but do find it “more relevant” than spread to APOR, at least with regard to a borrower’s ability to repay.

Their own loan loss model counts back-end DTI as a default risk variable, while risk premium is not included.

Additionally, they believe the DTI ratio “serves as a guardrail,” protecting homeowners from obtaining unaffordable mortgages.

They also point out that the DTI ratio provides value as a “countercyclical affordability constraint.”

If and when home prices become unsustainable again, in which prices far outpace income, the DTI ratio acts as a “safety valve” to limit demand, thereby slowing home price growth and rebalancing the market.

While it appears the CFPB’s mind seems to be made up regarding DTI, Fitch’s warning should certainly be considered before they make such a major change to the QM rule.

(photo: Marco Verch)